Are you unsure what expenses are deductible for you business? This

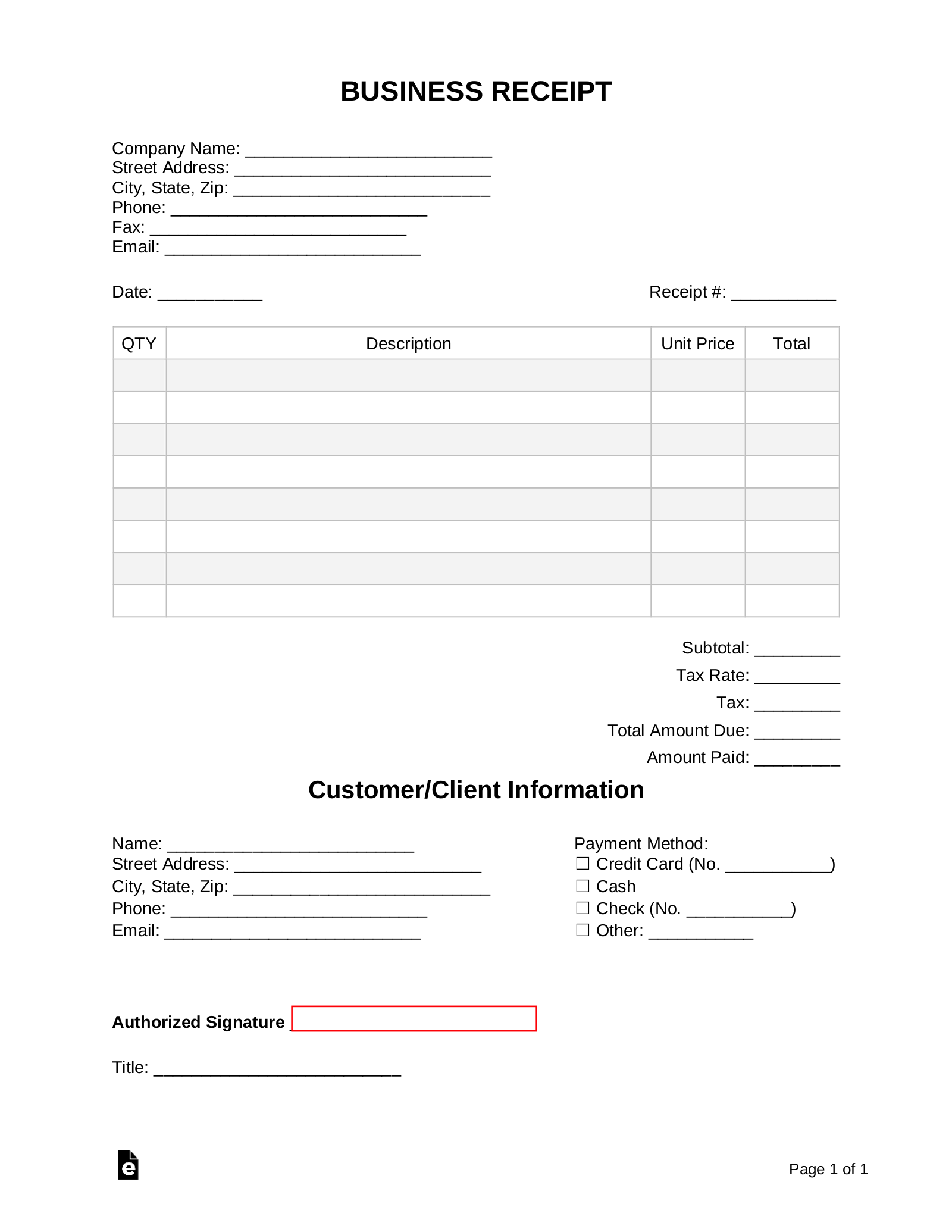

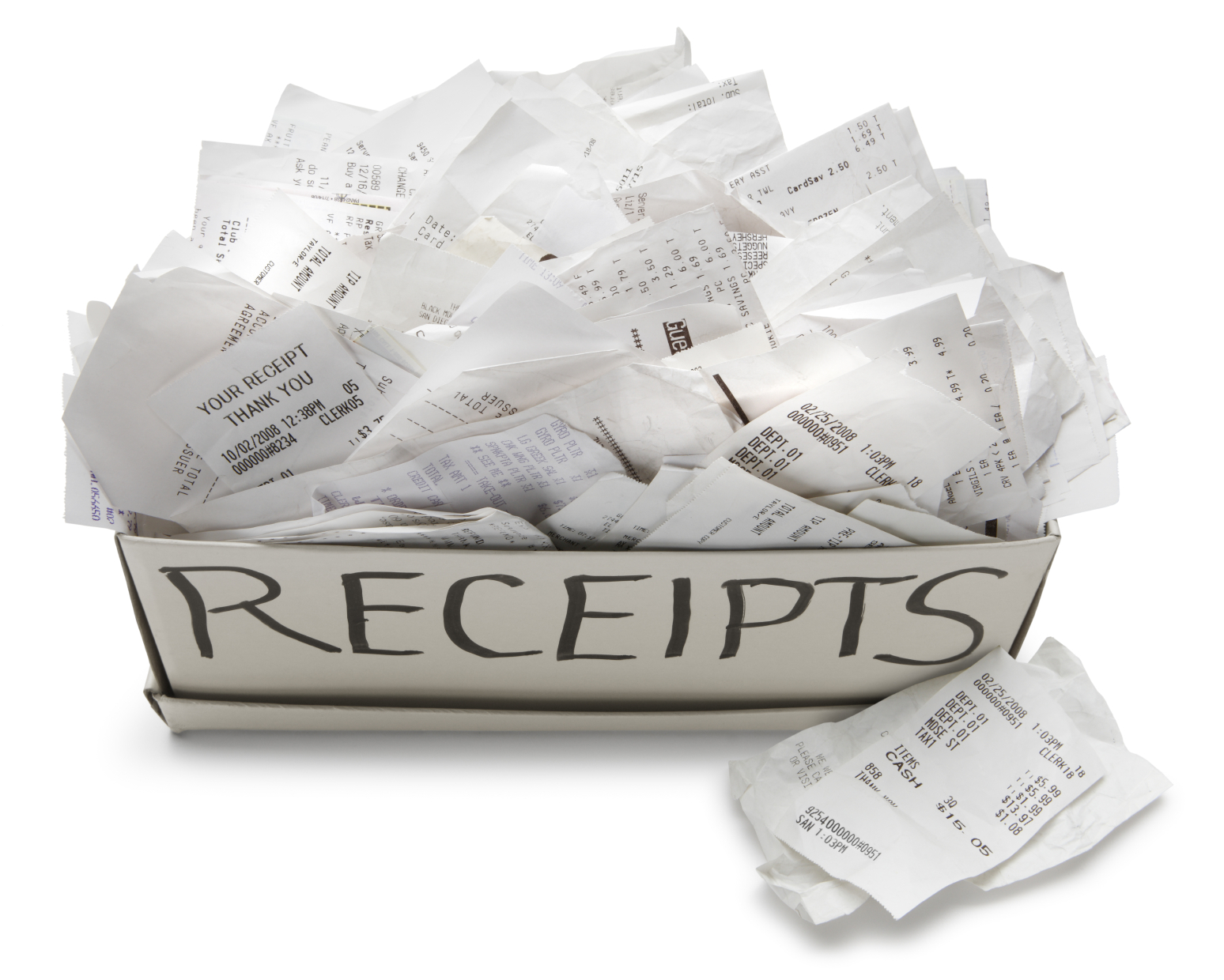

Gambling losses: If you are going to deduct gambling losses, you must have receipts, tickets, statements and documentation such as a diary or similar record of your losses and winnings. Technically, if you do not have these records, the IRS can disallow your deduction. Practically, IRS auditors may allow some reconstruction of these expenses if.

What Happens If You Get Audited And Don T Have Receipts Best Tax Pro

It's strain time real you don't have receipts since last year's business expenses. Instantly what? Them pot still claim deductions, but here are a few tips for protective yourself against an audit.

Erica Kent on LinkedIn POV It’s almost tax time and you don’t have

If you don't have original receipts, other acceptable records may include canceled checks, credit or debit card statements, written records you create, calendar notations, and photographs. The first step to take is to go back through your bank statements and find the purchase of the item you're trying to deduct.

Mazuma Accounting Archives Mazuma

Step 3: Look for alternate means to justify your reported expenses. If you don't have the receipt for an expense, you may still be able to claim some of all of the expenses by using alternative means. The Cohan Rule was outlined by the federal court system for just these circumstances.

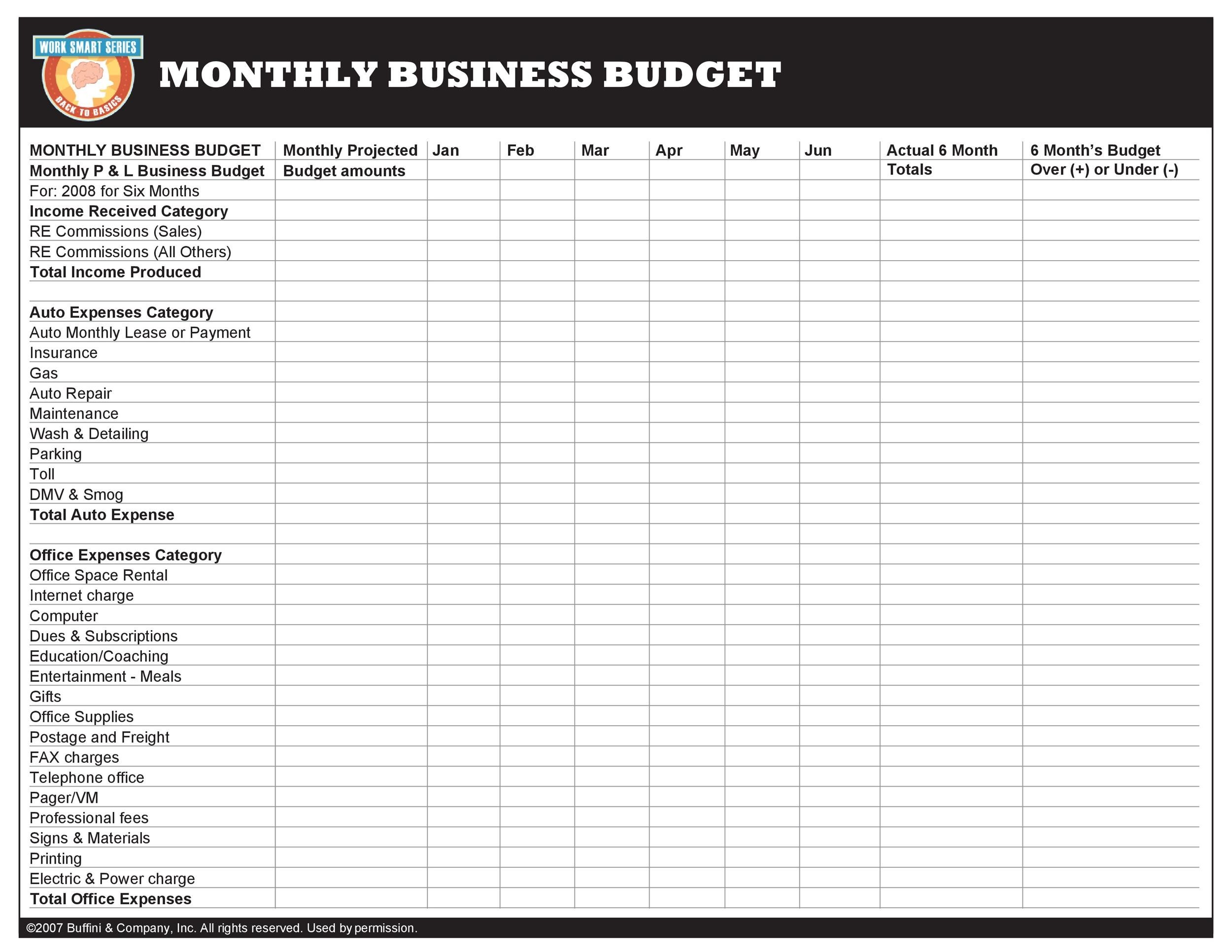

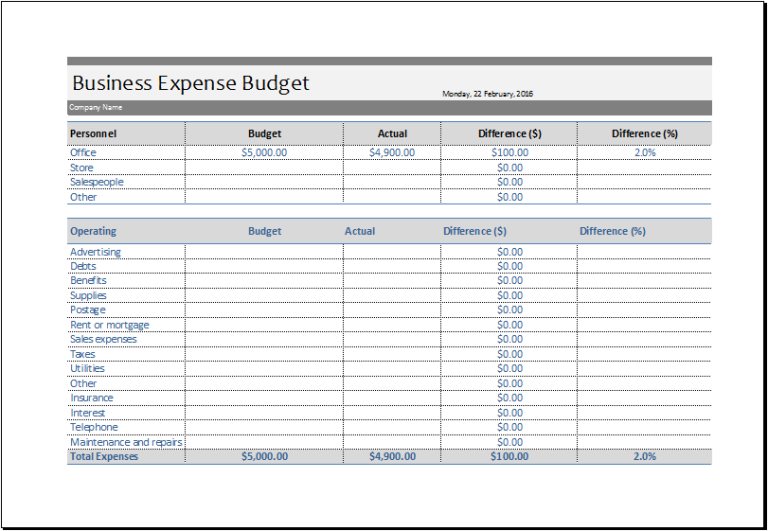

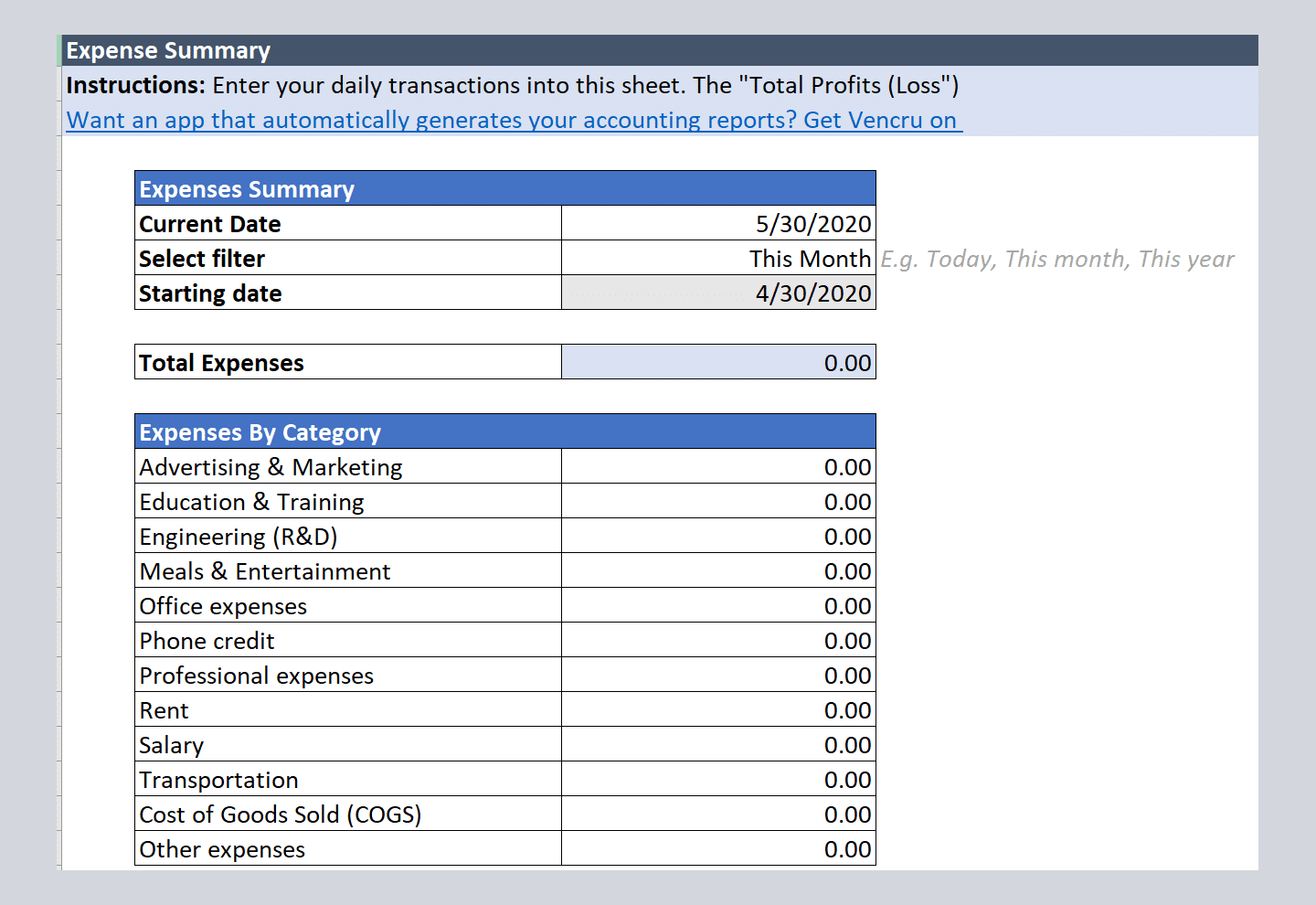

Company Budget Template Google Sheets

If the commission catches what seems to be intentional fraud, such as a taxpayer who submits fake receipts, an up to 75% interest penalty free can added to the tax bill. For example, if you owe the government $10,000 before the commission detects fraud, you get to pay an additional $7,500 in penalties.

Custom receipts lomirobot

If you can't provide receipts during an audit, the IRS will disallow any deductions claimed. However, you may be able to reconstruct records and present them to the IRS. This can be an explanation.

Business Expense Budget Template for EXCEL Excel Templates

It's trigger time real your don't have receipts for last year's business daily. Now what? You can still make deductions, but here are a few tips for protecting yourself against on audit.

Free excel accounting templates and bookkeeping spreadsheet Vencru

You will find yourself working through a maze of receipts, which have incomplete details, to determine your business expenses. This could have very dangerous consequences, as your tax return could be in peril. The fact of the matter is that receipts have to be taken seriously as they serve as an audit protection.

EXCEL of Daily Expenses Report.xls WPS Free Templates

This rule is still in effect, which means that taxpayers who are facing an audit and don't have all receipts are allowed to explain their reasons for claiming a tax deduction. However, the IRS imposes certain limitations on the Cohan rule. For example, IRS Code 274 restricts or eliminates tax deductions for entertainment, travel, and meal.

What Happens If You Get Audited and Don’t Have Receipts? 1800Accountant

It can be daunting and stressful if you are audited and don't have receipts. Take these steps if this happens to you: 1. Try Not to Panic. First, try to avoid unnecessary panic. Audits happen all the time, and many people don't have perfect recordkeeping processes.

Here's What Happens If You Get Audited and Don't Have Receipts

Receipts being the stock in trade of the tax system, the trial court upheld the IRS. Again, Mr. Cohan wouldn't take no for an answer and appealed to the Second Circuit. The Appeals Court held.

What happens if you get audited and don't have receipts? Blog

It's tax time and you don't have receipts on last year's business expenses. Currently what? You can still claim deductions, but here are a few tips on protecting yourself against in audit.

Comment Gérer les Dépenses de Votre Entreprise et Réduire les Coûts

If you don't have receipts, you may not be able to claim the full amount of deductions unless you can prove your claims are legitimate. Missing receipts could mean you have inaccurate records and tax returns, which could trigger an audit. Businesses can avoid audits with accurate and organized bookkeeping year-round.

Designer Elite Bookkeeping on LinkedIn It’s tax time and you don’t

It is during the tax audit that the IRS will expect you to provide receipts that documents all of your claimed expenses and related deductions. If you are heading into an audit and know that you have not reported significant business income to the IRS, it is generally a good idea to hire a tax pro to represent you during the audit.

Mazuma's YearEnd Business Accounting Checklist Mazuma Small

It's charge time press your don't have receipts with last year's business total. Now what? You can still demand deductions, but here are a few tips for protect yourself counter an internal.

10 Apps That Manage Pesky Business Receipts (And Will Save Your Sanity

It's tax laufzeit and you don't may receipts for last year's corporate expenses. Now what? You can still claiming deductions, but here are an several tips for protected yourself against an audit.