PPT Vertical Analysis PowerPoint Presentation, free download ID1476017

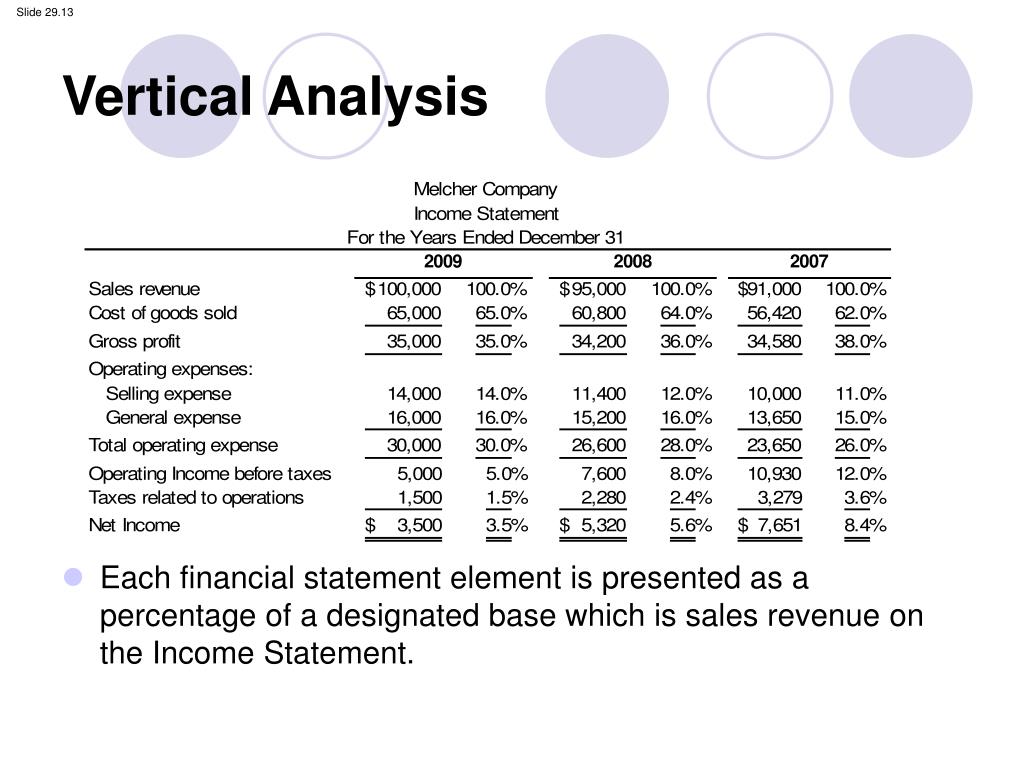

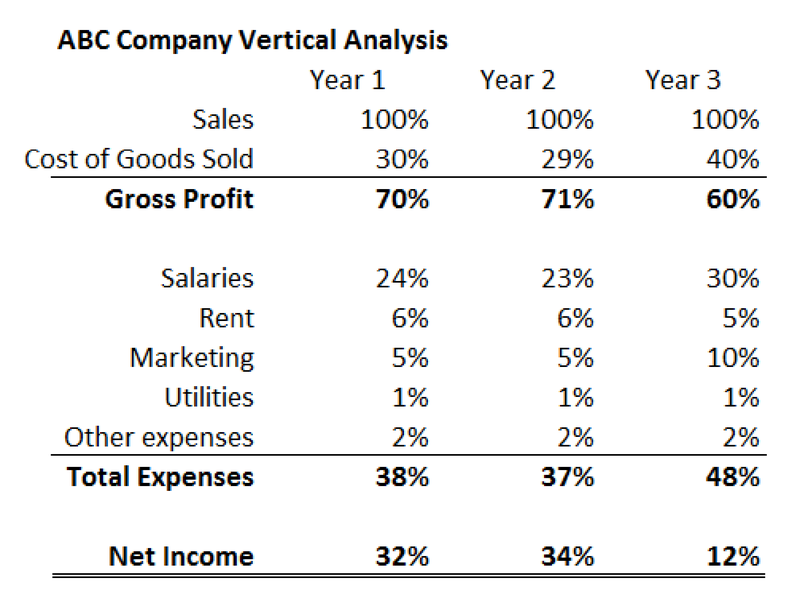

The vertical analysis also shows that in years one and two, the company's product cost 30% and 29% of sales, respectively, to produce. In year three, however, cost of goods sold spikes to 40% of.

[Solved] Please help with my review! 1. Explain briefly the ratios and other... Course Hero

The vertical analysis formula can give insight into a company's sales, expenses or revenue streams. While the formula is usually used to understand a company's finances at a glance, it can also be used for more in-depth analysis into what sort of trends a company is facing in its designated market. Here are some examples of how the formula.

Vertical Analysis Meaning, Formula, Calculation & Interpretations YouTube

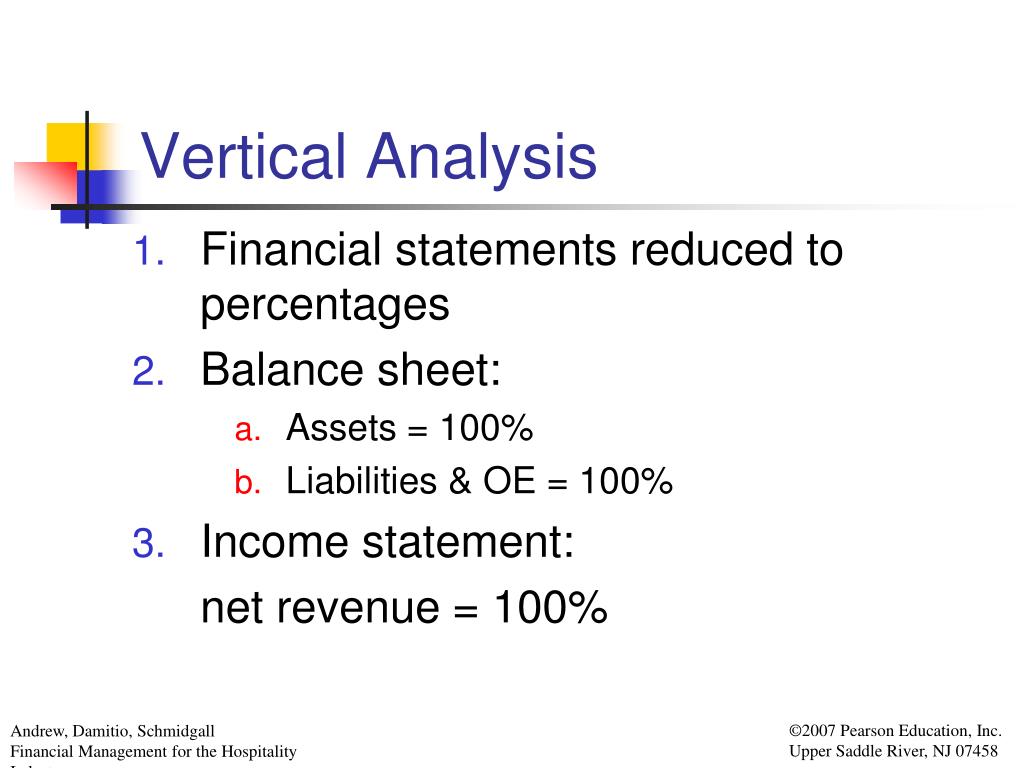

Vertical analysis formula. The vertical analysis formula, also known as the common-size ratio, is a way to express each line item on a financial statement as a percentage of a base amount. Each line item's common-size ratio can then be used to conduct comparative analysis across different fiscal periods or companies, allowing for a.

PPT Analytical Analysis Selective Use of Ratios PowerPoint Presentation ID5765104

Here is a comparison of each of the formulas for vertical analysis and horizontal analysis: Vertical analysis formula = (Statement line item / Total base figure) X 100. Horizontal analysis formula = {(Comparison year amount - Base year amount) / Base year amount} X 100. However, it is important to remember that you can still use vertical.

What is Vertical Analysis? Definition Meaning Example

Vertical Analysis Formula. The vertical analysis formula is a very easy-to-use, straightforward percentage formula. It is as follows: In order to use the vertical analysis equation, you need to figure out your base figure. On a business's balance sheet, you can find the relevant base figure as the company's total assets or liabilities.

EXCEL of Statement Vertical Analysis Template.xlsx WPS Free Templates

The above-mentioned is a general formula for vertical analysis. The specific formula for the common-size balance sheet and income statement is as follows: Common-size Balance Sheet = (Concerned Item of Balance Sheet/Total Assets or Liabilities) * 100. Common-size Income Statement = (Concerned Item of Income Statement/Total Sales) * 100.

Vertical Analysis Formula (Examples) How to Calculate it? YouTube

Vertical Analysis Formula. The formula for vertical analysis is straightforward. You simply divide the figure for a specific line item by the total assets (for a balance sheet) or total sales (for an income statement) and then multiply the result by 100 to get a percentage. This formula can be expressed as:

Vertical Analysis Double Entry Bookkeeping

Vertical Analysis Formula. The vertical analysis of financial statements is concerned with the proportion of the total amount that each line item represents. This is calculated by dividing the value for each line item by the total and multiplying by 100. % of total = (line item value / total value) * 100.

A Beginner's Guide to Vertical Analysis in 2021 The Blueprint

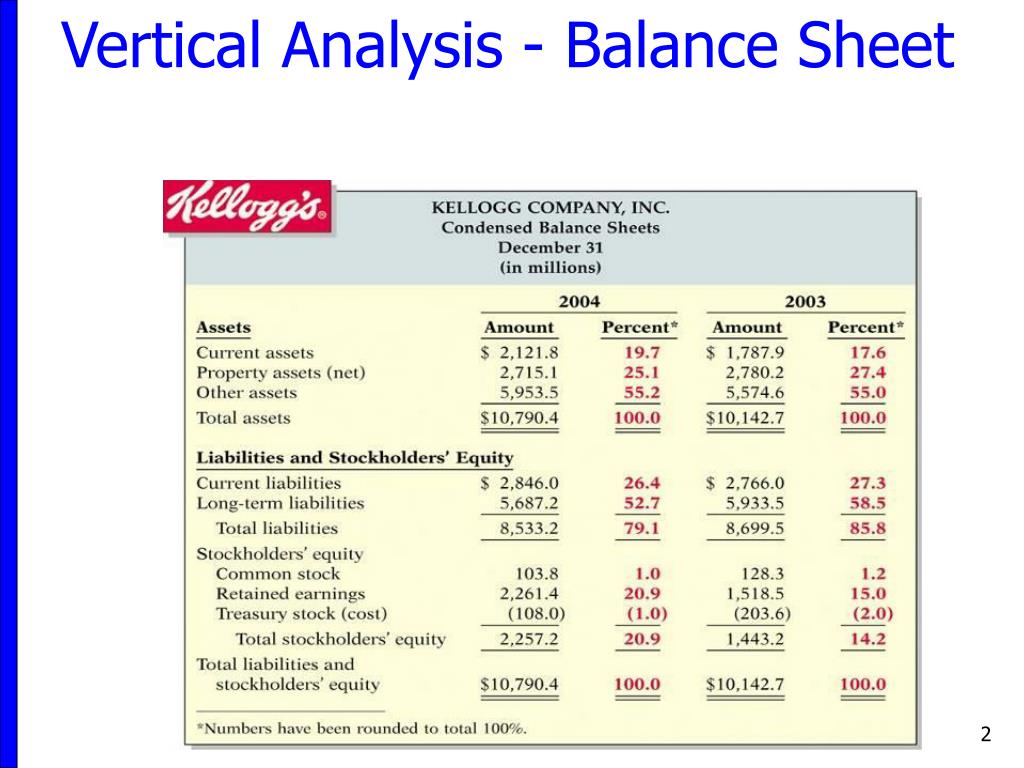

Vertical analysis is a method of financial statement analysis in which each entry for each of the three major categories of accounts, or assets, liabilities and equities, in a balance sheet is.

What is Vertical Analysis? Formula + Calculator

What is the formula for vertical analysis? (Line item/ base amount) x100 . How is vertical analysis used in financial analysis? Vertical analysis is used on a balance sheet, income statement, and cash flow statement and is used to understand each line item as compared to the base amount. You can use this to compare companies of different sizes.

Excel Vertical Analysis, Horizontal Analysis

The vertical analysis formula is known as the common-size ratio (or percentage). It is: Common-Size Ratio = (Comparison Amount/Base Amount) x 100. The comparison amount is a line item in the same.

PPT Vertical Analysis PowerPoint Presentation, free download ID1476017

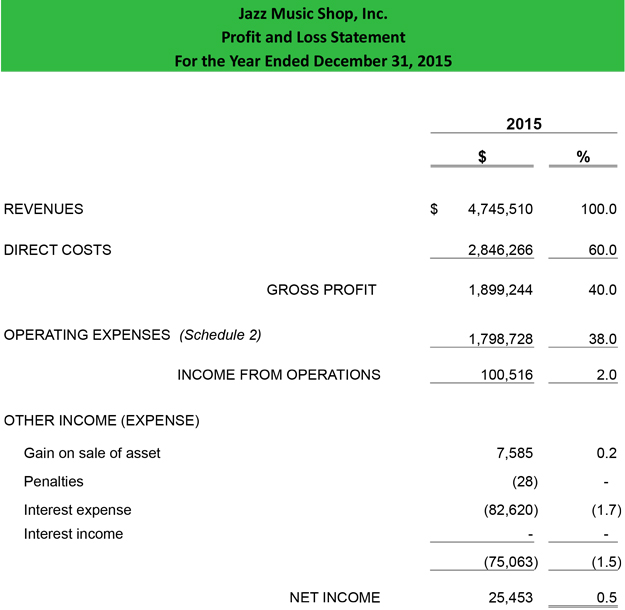

The formula to perform vertical analysis on the income statement, assuming the base figure is revenue, is as follows. Vertical Analysis, Income Statement = Income Statement Line Item ÷ Revenue. In contrast, the process is practically the same for the balance sheet, but there is the added option of using "Total Liabilities" instead of.

vertical analysis of balance sheet example YouTube

Vertical Analysis - Formula and Advantages. To calculate the percentage for the vertical analysis of financial statements - with reference to the income statement and the balance sheet, the formulas are: Vertical Analysis (Income Statement) = Item in Income Statement/Total Sales * 100.

Vertical Analysis What It Is and How It Can Help You Acterys

Vertical analysis is the proportional analysis of a financial statement, where each line item on a financial statement is listed as a percentage of another item. This means that every line item on an income statement is stated as a percentage of gross sales, while every line item on a balance sheet is stated as a percentage of total assets.

Vertical Analysis Datarails

Example of Vertical Analysis Formula. Example of the vertical analysis accounting of the financial statement, which shows the total amount and percentage.. The total sales are $1000000, and the cost of goods sold Cost Of Goods Sold The Cost of Goods Sold (COGS) is the cumulative total of direct costs incurred for the goods or services sold, including direct expenses like raw material, direct.

PPT Chapter 5 Financial Statement Analysis PowerPoint Presentation, free download ID814237

A Vertical Analysis Calculator is a tool that can be used to calculate the vertical analysis ratio for a given line item and base figure. The formula for the vertical analysis ratio is: VA = (SL / B) * 100. Where VA is the vertical analysis percentage, SL is the amount of the line item being analyzed, and B is the total base figure for the.