Client Tax Organizer 100 Organizers

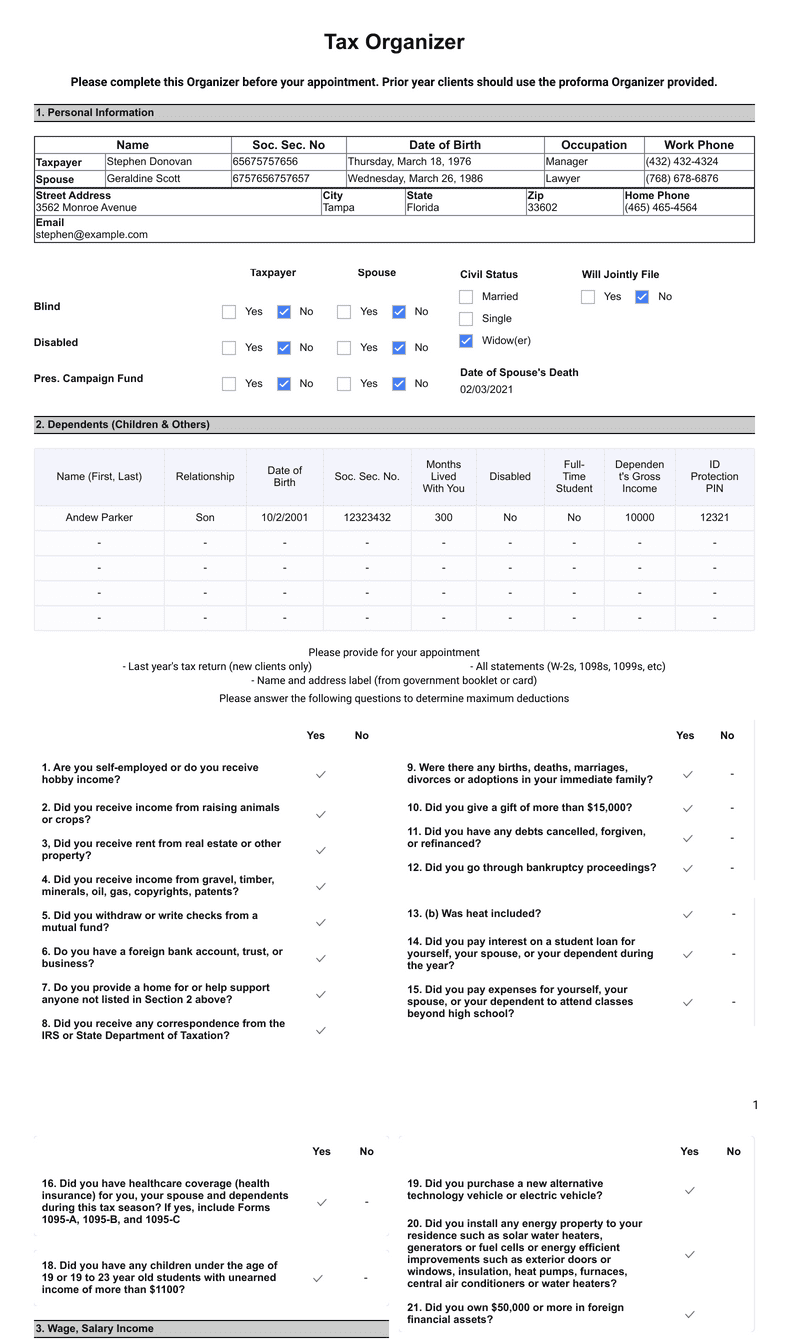

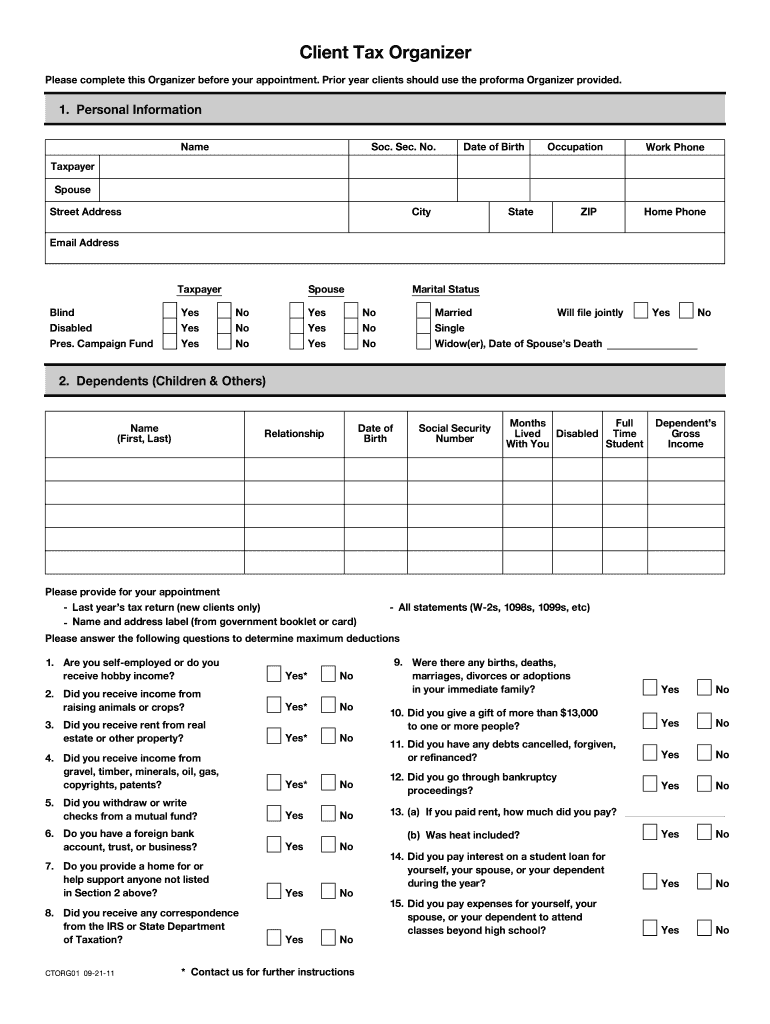

1. Click on the "View Tax Organizer" button below to bring up the organizer in a new window. 2. Print the organizer by clicking on the printer icon on the top of the screen. 3. Fill out all the information you can. 4. Call us and schedule a meeting. 5. Bring the completed tax organizer and all supporting documents to the meeting.

Downloadable tax organizer for 2018 tax preparation. Tax

1-48 of over 1,000 results for "Business Tax Organizers" Results Overall Pick PocketCPA Receipts Organizer & Expense Envelopes. 3-in-1 Organizers that Store Receipts, Record Expenses & Track Mileage. With Small Business Ledger, Mileage Log & Easy Receipt Finder System. 12/Pack. 2,013 500+ bought in past month $1599 ($1.33/Count)

Small Business & Expense Tax Organizer — Atkins E Corp Small

Throughout the tax organizer, you will find columns with the heading "TSJ". Enter "T" for taxpayer, "S" for spouse or "J" for joint. Worksheets: Basic Data > General and Return Options > Processing Options. 200131 04-01-22. Forms 1, 1A and 2.

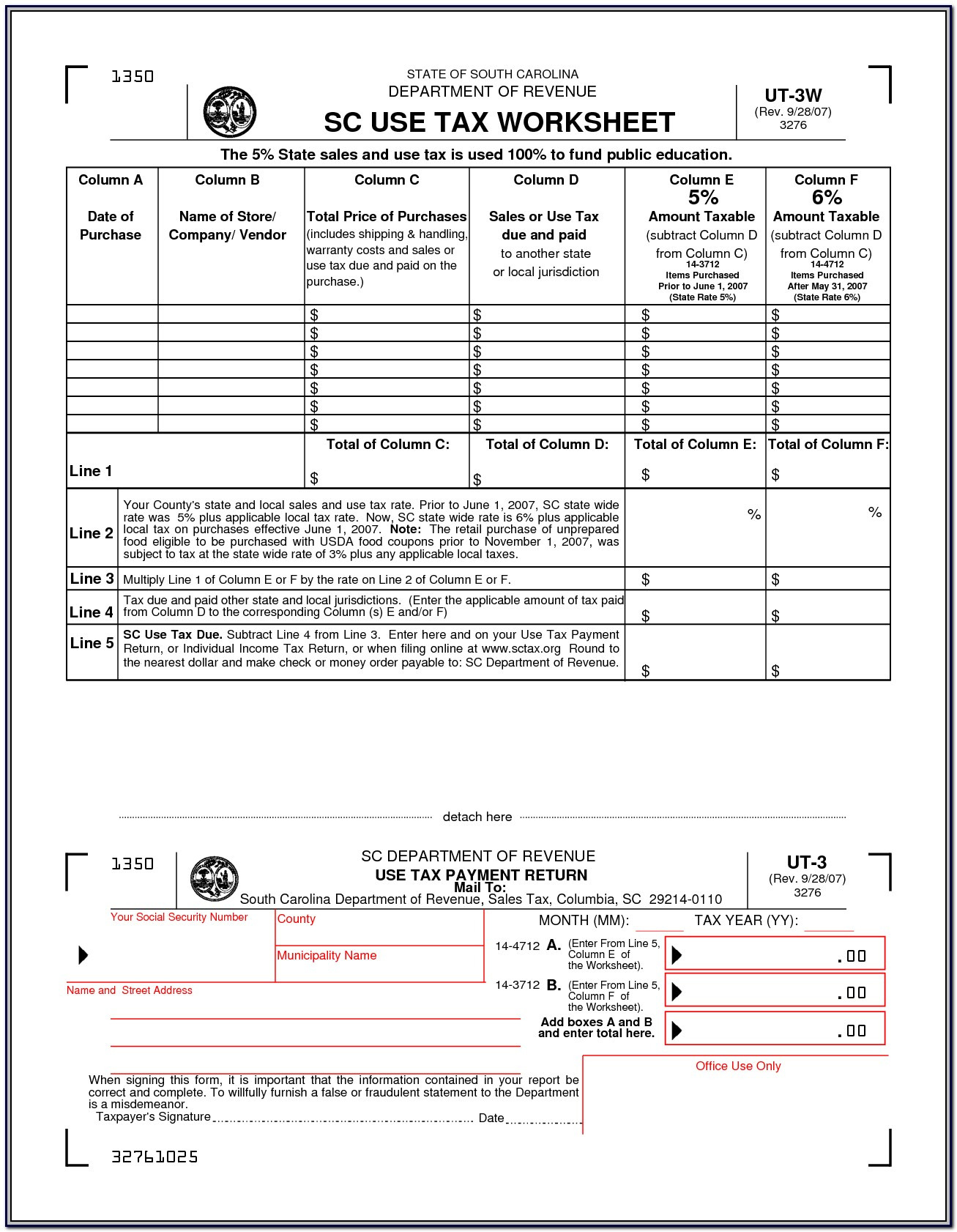

2018 Form UT Butler Tax & Accounting Small Business Tax Organizer Fill

Since 2003, we've provided tax preparation services to over 300 individuals and 150 small businesses. Learn more about what makes our clients stay.. Book your one-on-one consultation and download your Individual Tax Organizer or Business Tax Organizer to make sure you have all of your documents ready for your VAAS Pro Tax Consultant.

Tax Organizer Worksheet For Small Business —

1. Know your deadlines Tax filing deadlines vary depending on business entity type. This year, for example, the deadline for corporations was April 15, while sole proprietors have until May 17.

Tax Organizer Worksheet For Small Business Worksheet —

Small Business and Self-Employed (SB/SE) Tax Center. Do you need help with a tax issue or preparing your return, or do you need a free publication or form? The SB/SE Tax Center serves taxpayers who file Form 1040; Form 1040-SR; Schedule C, E, or F; or Form 2106, as well as small business taxpayers with assets under $10 million..

Pin on organize

Resources for taxpayers who file Form 1040 or 1040-SR, Schedules C, E, F or Form 2106, as well as small businesses with assets under $10 million. Most Popular Business tax account

Client Tax Organizer 100 Organizers

Small Business 2 Pack Expanding File Folder,A6 Mini Accordion File Organizer,13 Pockets Rainbow Receipt Organizer Wellet for Monthly Bills,Cards,Check Coupons,Vouchers,Receipt Tax Item or Changes,Coupon Organizer 147 50+ bought in past month $699 FREE delivery Thu, Sep 21 on $25 of items shipped by Amazon Or fastest delivery Wed, Sep 20

Printable Tax Forms Get Organized Small business tax, Budgeting

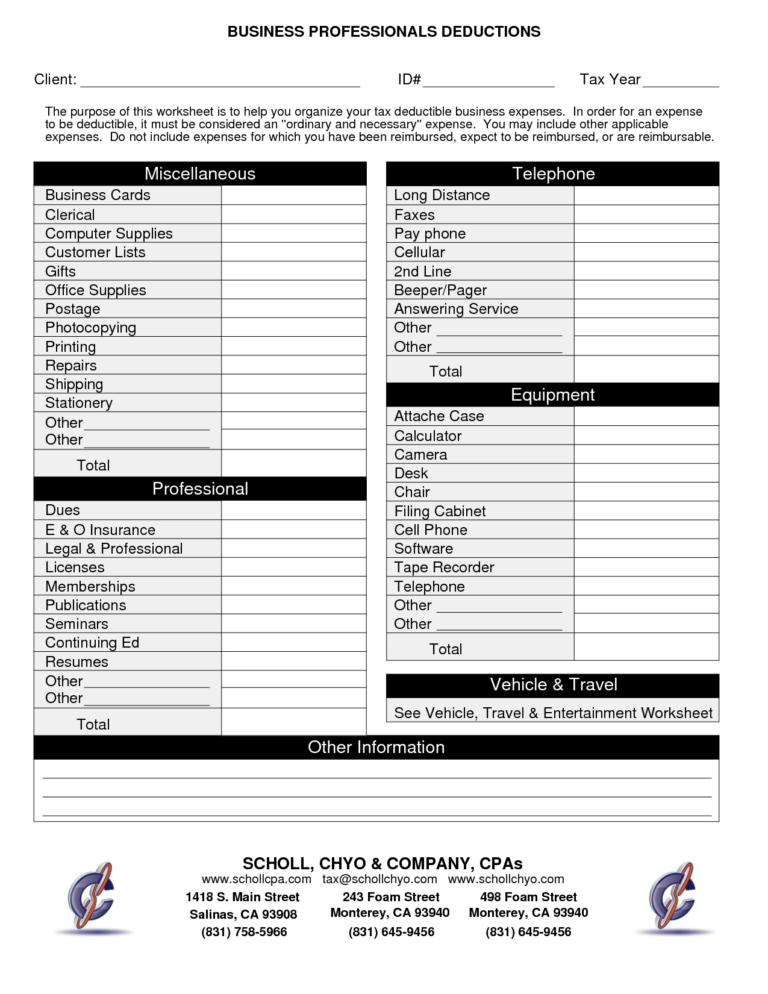

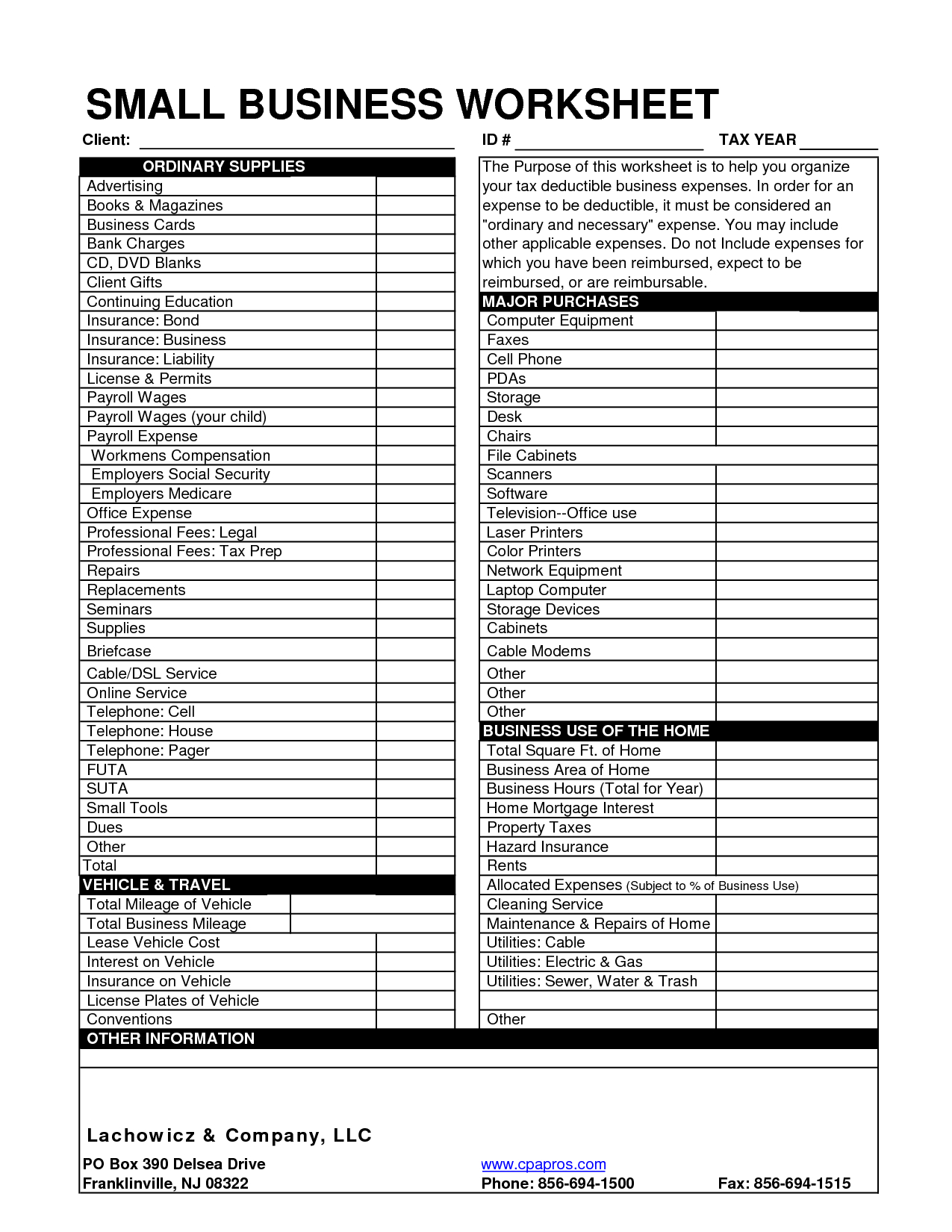

Tax Organizer The Self‐Employed Tax Organizer should be completed by all sole proprietors or single member LLC owners. It has been designed to help collect and organize the information that we will need to prepare the. *Most small businesses follow the cash method of accounting. If you are unsure, please select cash. Type of Business.

HOW TO ORGANIZE YOUR SMALL BUSINESS TAXES (+ free printables!) Use

Small Business Tax Organizer (1 - 60 of 166 results) All Sellers Sort by: Relevancy Tax Deductions Tracker Spreadsheet, Tax Cheat Sheet Google Sheets Excel Template for Individuals, Australian Tax Preparation (4) $4.07

Tax Organizer PDF Templates Jotform

Make your taxes easy. Download a tax organizer for your 1040, 1004EZ, Schedule C, Corporate, Small Business, or Non Profit Tax Filings.

Tax Organizer RecordKeeper File Envelope

1. Know the types of small business taxes All businesses have to pay certain taxes to the IRS and state tax authorities. As a small business owner, it's your responsibility to ensure that you meet your federal and state tax obligations.

What Is Tax Organizer Fill Online, Printable, Fillable, Blank pdfFiller

Resolution #6: Use a Business Credit Card for Expenses. Tax preparedness is about getting organized and automating as much of the process as possible. The less manual legwork, the more time you'll have to spend generating revenue for your business. One of the best ways to organize your business expenses is to use a business credit card.

Tax Spreadsheet 2018 —

Small Business Credit Card Receipt Organizer Envelopes. Stores & Organizes Your Receipts. Tracks Your Credit Card & Debit Card Use. Matches Charges to Your Monthly Statement. 12/Pack. 9.5" x 6.5". By PocketCPA. 105 100+ bought in past month $1699 ($1.42/Count) $16.14 with Subscribe & Save discount

Tax Donation Spreadsheet with regard to Clothing Donation Tax Deduction

It also has a K-1 package and a tax planner with the ability to project multiple case scenarios. The pricing for ProConnect Tax Online's pay-per-return ranges from $36.95 to $97.95 for individual returns and $40.95 to $117.95 for business returns, which is based on the quantity of returns. Those who gave a ProConnect Tax Online review had.

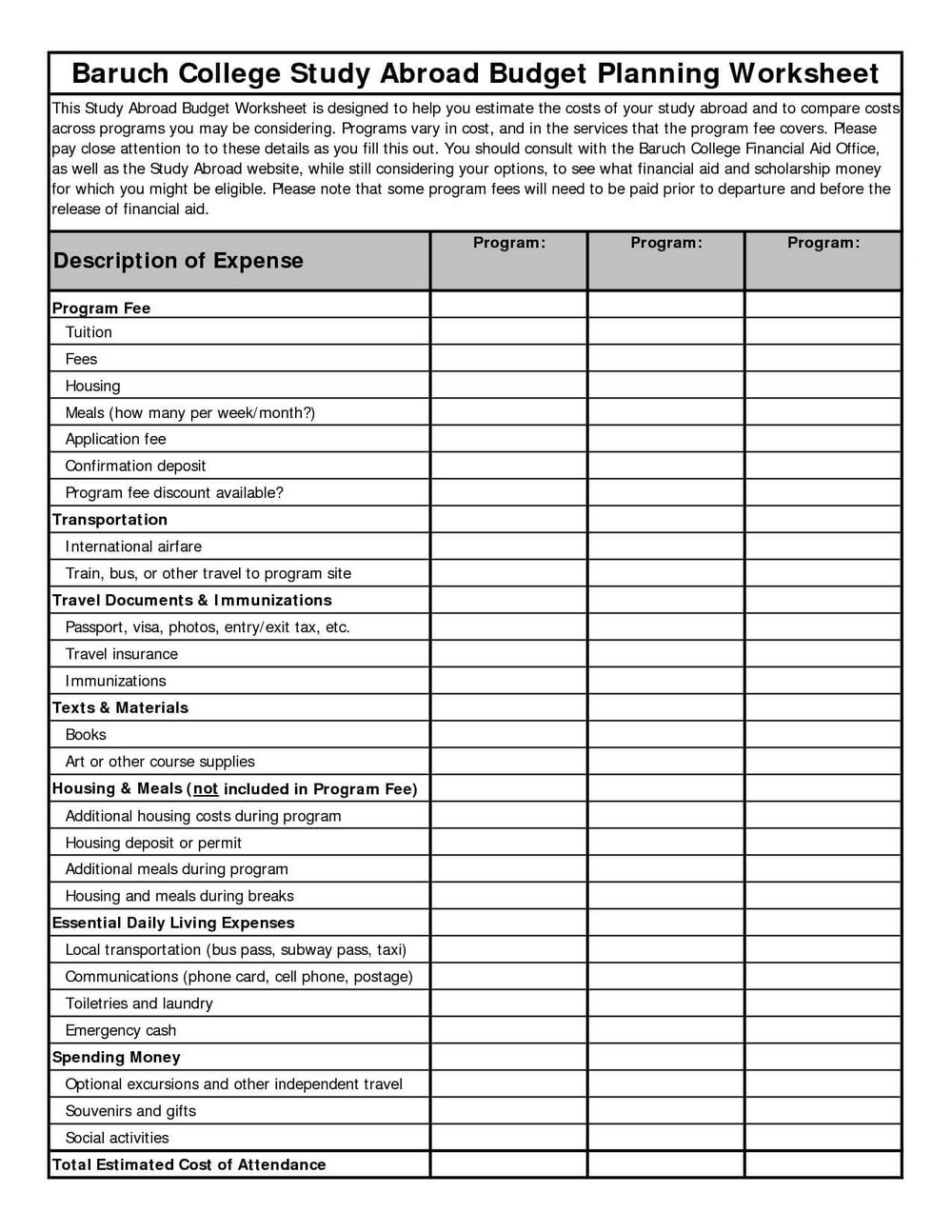

Get your FREE Small Business Tax Organizer for 2018 Tax Prep

PocketCPA Smart Ledger - Sorts, Groups & Records Expenses by Category/Small Business Expense Ledger & Organizer/Effortless Bookkeeping, Expense Tracking & Tax Preparation / 50 Sheets - 8.5 x 11". 42 $1699 Join Prime to buy this item at $14.44 FREE delivery Fri, Dec 22 on $35 of items shipped by Amazon Or fastest delivery Thu, Dec 21